Top Reasons to Invest in Cyprus

Cyprus is a modern, cosmopolitan, transparent business centre offering opportunities for investment across a wide range of sectors.

In Cyprus, laws and regulations, systems and infrastructures, are all continuously enhanced to ensure we remain one step ahead. Cyprus is committed to offering a high-quality service in a duly regulated environment in order to ensure the best possible experience for investors and business people worldwide.

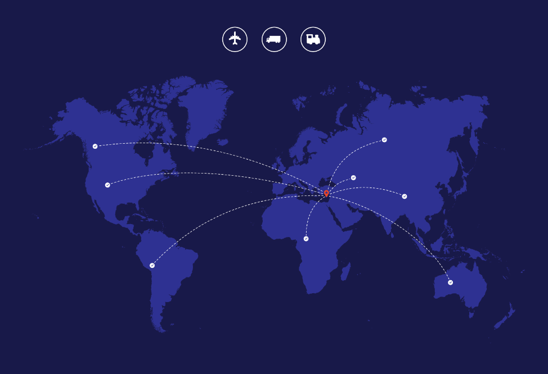

Access to markets

With its ideal geographical position at the crossroads of three continents – Europe, Africa and Asia, Cyprus is an ideal investment gateway to the European Union, as well as a portal for investment outside the EU, particularly into the Middle East, India and China.

EU Member since 2004 and Eurozone member since 2008

- A robust and modernized business hub with easy access to a market of 500 million EU citizens

- A reliable partner within the European Union that can offer competitive benefits and solid business solutions

- Companies in Cyprus have full access to European markets and EU trade agreements

- Part of the European Single Market; enjoying free movement of goods, services and capital

- More than 40 European Union trade agreements

- More than 60 double tax treaties

Geostrategic position

- Proximity & easy access to major markets

- 2nd fastest growing country brand worldwide (Brand Finance 2017)

Attractive tax system

Cyprus has a simple and transparent tax system with one of the lowest corporate tax rates in the EU and multiple exemptions for both corporates and individuals.

The main characteristics of the Cyprus tax system are outlined below:

- Low corporate income tax rate of 12.5%

- EU & OECD Compliant

- Access to EU directives (e.g. Parent-Subsidiary)

- Extensive double tax treaty network with over 60 countries

- Dividend participation exemption (subject to conditions)

- Exemption from tax on gains from the disposal of securities (e.g. shares, bonds)

- Notional interest deduction on equity applies to all taxpayers and all business activities

- No withholding taxes on interest and dividends

- No taxation of capital gains (except for disposal of real estate in Cyprus or shares of company holding real estate in Cyprus)

- No succession taxes

- No Controlled Foreign Company (CFC) rules

- Tax neutrality on foreign exchange differences unless they arise from trading in currencies or currency derivatives

- Foreign tax relief on income subject to both Cypriot and overseas tax

- Exemption on profits of foreign permanent establishments (subject toc onditions)

- Company reorganisation rules based on the EU Mergers Directive allow for tax-neutral group restructuring

- Attractive Intellectual Property regime in line with “modified nexus approach” (OECD Action 5)

- No exit tax rules

- 50% exemption on employment income exceeding €100,000 per annum for non-residents taking up employment in Cyprus

- No tax on dividends, interest and rental income of non-domiciled individuals

Income tax for new residents

- Income more than €100K/year:

/ Exemption from personal income tax of 50% for new residents

/ Applies for the first 10 years of employment in Cyprus

- Income less than €100K/year

/ Exemption from personal income tax of 20%, up to a maximum of €8.550 per annum for 10 years

Investor’s tax benefits:

- Non-domiciled individuals who are tax residents of Cyprus are not taxed on passive income.

The attractive tax system of Cyprus, together with its EU accession has helped Cyprus establish itself as an ideal holding company location in the EU. There are over 17,000 foreign companies (named International Business Companies IBC’s) that currently use Cyprus.

Main advantages of taxation system:

- Cyprus’ current tax system is in full compliance with the EU and OECD.

- Taxable profits of all Cypriot companies are taxed at the rate of 12.5% (however, effective corporate tax rate is NIL for most international transactions through Cyprus).

- Extensive double tax treaty network (Cyprus has double taxation treaties with Austria, Bulgaria, Canada, the People’s Republic of China, the Czech Republic, Denmark, Egypt, France, Germany, Greece, Hungary, India, Ireland, Italy, Kuwait, Malta, Norway, Poland, Romania, Russia, (Armenia, Belarus, Kurdistan, Moldova, Tajikistan, Turkmenistan and Ukraine) Slovakia, South Africa, Sweden, Syria, the United Kingdom, the United States of America, the former Yugoslavia (Serbia and Montenegro) and other countries.

- Gains from the disposal of securities are tax exempt.

- Profits earned from a permanent establishment abroad are fully exempt from corporation tax (under certain conditions).

- Dividend income received in Cyprus from a foreign corporation is wholly exempt from taxes in Cyprus (under certain conditions).

- Interest income earned from trading activities, including interest which is closely related with trading activities, is subject to income tax at 12.5%.

- No withholding tax on dividends and interest paid to non-residents of Cyprus. Also, no withholding tax on royalties arising from sources outside Cyprus.

- Group relief provisions for companies resident in Cyprus.

- Capital gains are not subject to tax, except on sale of immovable property situated in Cyprus.

- No Import Tax: European citizens who become permanent residents in Cyprus and who owned and used a car in their country for at least six months can bring it into Cyprus and they will not pay any Import Tax. Furniture can be imported free of any taxes by Europeans or non-Europeans who become permanent residents, provided that it is for personal use and is not brand new.

INCOME TAX RATES

| Tax % | Tax Base (EUR) |

| 0% | Up to 19,500 |

| 20% | 19,501-28,000 |

| 25% | 28,001-36,300 |

| 30% | €36,301-60,000 |

| 35% | 60,001 and over |

Retirees who become residents in Cyprus are taxed on their pensions from abroad at the rate of 5% per annum, while an annual exception for the first €3,420 is granted.

IMMOVABLE PROPERTY TAX

The annual immovable property tax is calculated on the market value of the property as at 1st January 1980 .

| Property Value 01.01.1980 | Property Tax Rates |

| First €40,000* | 0.6% |

| Next €80,000 | 0.8% |

| Next €50,000 | 0.9% |

| Next €130,000 | 1.1% |

| Next €200,000 | 1.3% |

| Next €300,000 | 1.5% |

| Next €2,200,000 | 1.7% |

| Excess over €3 million | 1.9% |

*Property owners whose property has a total value of €12,500 or less (using values from 1st January 1980) are exempt from Immovable Property Tax.

Taxpayers who settle their 2016 immovable property tax liability by 31 October 2016 are entitled to a 75% discount. If the liability is settled between 1 November and 31 December 2016 the taxpayer is entitled to a discount of 72.5%. If the liability is settled after 31 December 2016 it will be discounted by 69.75%. If the total liability after any discount is less than €10, it will be waived.

Immovable property tax will be abolished with effect from the beginning of 2017.

CAPITAL GAINS TAX

Capital Gains Tax is levied at the rate of 20% on gains arising from the disposal of immovable property or the disposal of shares of companies, the assets of which consist mainly immovable property.

Subject to certain conditions, individuals may claim the following deductions:

- Up to €85,430 if the disposal relates to a private residence.

- Up to €25,629 if the disposal is made by a farmer and it relates to agricultural land.

- Up to €17,086 on any other disposal.

These deductions are granted once in the lifetime of the individual, until fully exhausted and if an individual claims a combination of them, the maximum deduction granted cannot exceed €85,430.

INHERITANCE TAX

Inheritance Tax was abolished as from 1/01/2000.

COUNCIL TAXES

Council Taxes are payable to the Council at which your property is listed at the end of each year. The said taxes are due to be paid by you once you get the delivery of the property and not prior to that.

Council Taxes are of the approximate amount of EUROS 400= per year depending always at which Council your property is listed.

STAMP DUTY FEES

The Purchaser is liable for the payment of Stamp Duty on the purchase price of the property at the following rates:

| First €5,000 | €0.00 |

| €5,001 to €170,000 | 0.15% |

| over €170,001 | 0.20% |

The documents should be stamped within 30 days after their signing in order to avoid the payment of a fine, which could be a substantial amount of money.

TRANSFERING FEES

Real Estate Transfer Fees are imposed by the Land Registry Office in order to transfer FREEHOLD ownership to the name of the Purchaser. The transfer fees are due for payment when the transfer of the Title Deed in the name of the Purchaser takes place. The Purchaser is solely responsible for the payment of the Transfer Fees. The rates are on a graduated scale.

The transfer fees are calculated as follows:

| Property value (Euros) Transfer fees | Accumulated Transfer Fee (Euros) |

| up to € 85.430,07 | 3% |

| from € 170.860,15 and over | 8% |

If the property is in joint names e.g. a couple – husband and wife or two individuals, then the purchase value is divided into two parts which results in reduced Transfer Fees.

An amendment regarding the reduction of Immovable Property Transfer Fees has been approved by the Cyprus House of Representatives. This new measure which is currently in effect will remain in force until the end of 2016. It applies only to the first sale of a property and it abolishes or reduces Transfer Fees provided that the Contract of Sale has been deposited with the Land Registry within the month period set by the law. More specifically:

• No Transfer Fees will be payable for properties which are subject to VAT.

• Transfer Fees are reduced by 50% for those who do not pay VAT on their purchase.

For more information, please click here for the Cyprus Tax Guide.

Low cost of doing business

Labour costs:

- Lower costs for technical and professional talents than in other major EU capitals

- Average hourly rate: €15.8

- UK (€26.7) Germany (€33.0) the Netherlands (€33.3)

- Low non-wage employment costs: 17%, EU (26%)

Office space and business support:

- Among the lowest office rental rates in Europe

- Highly affordable critical business support services

Access to talent

Local talent

- The youngest population & workforce in the EU

- 55% of the workforce has a tertiary degree

- Many Cypriots study abroad, mainly in UK, USA & Europe

- Booming private education sector

- 3 public & 5 private universities

- Visa-free access to European talent

- 240 million people of workforce in the EU

- 7 million European university graduates per year

Access to global talent

English language